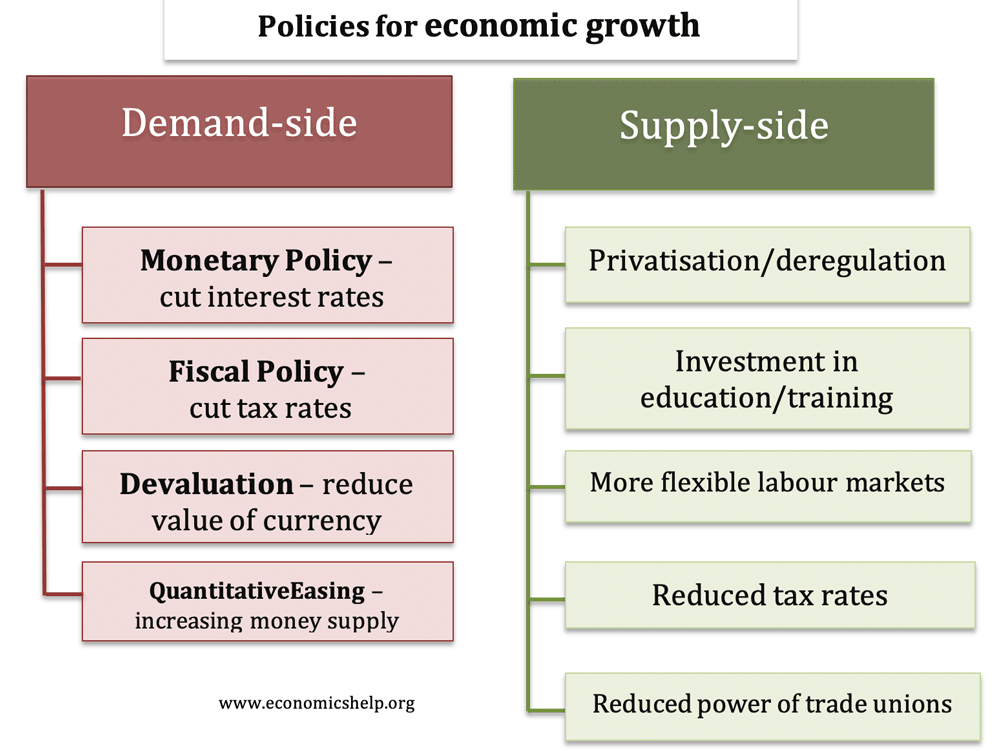

Different types of economic policies

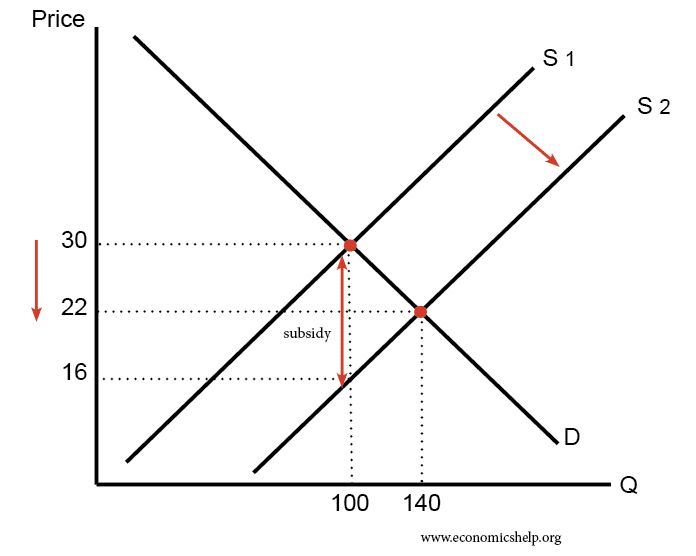

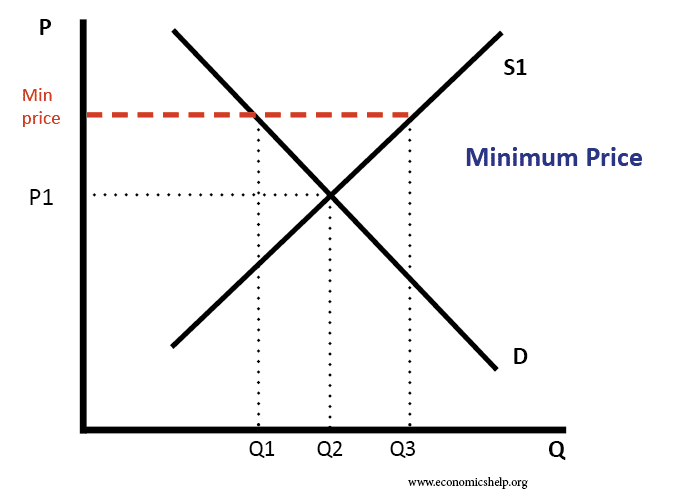

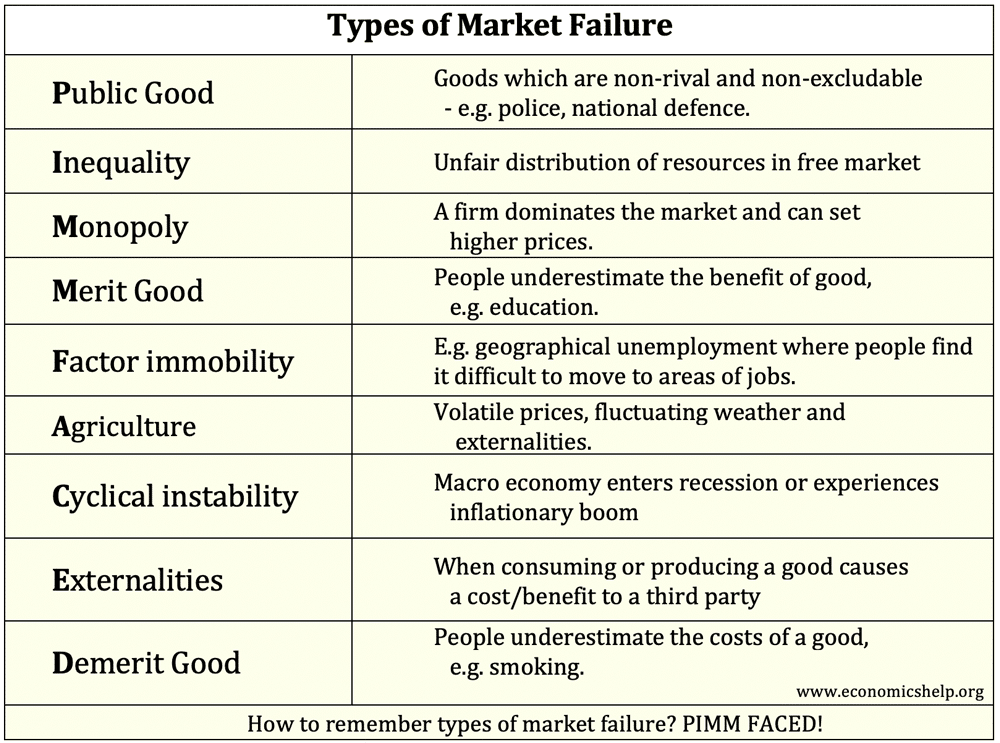

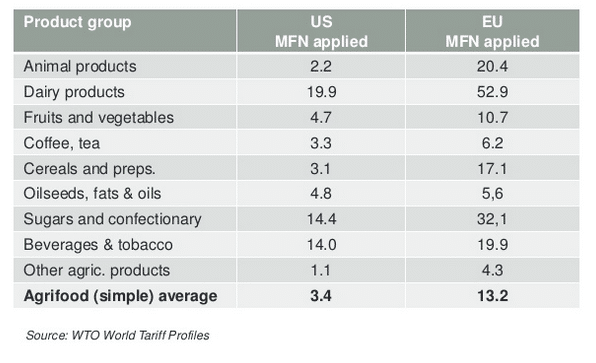

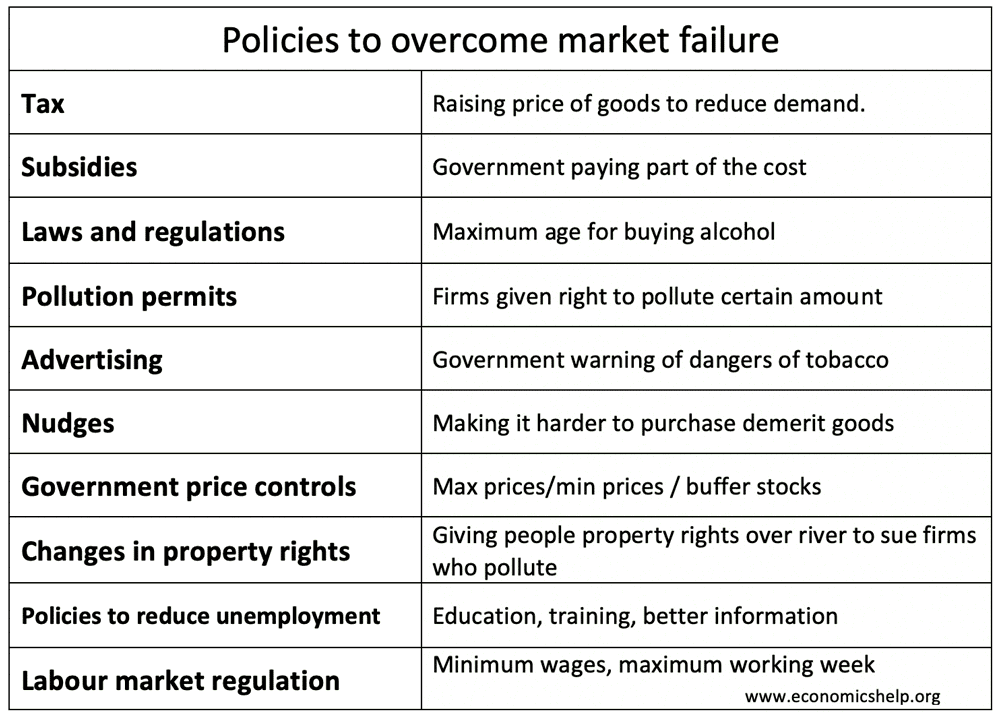

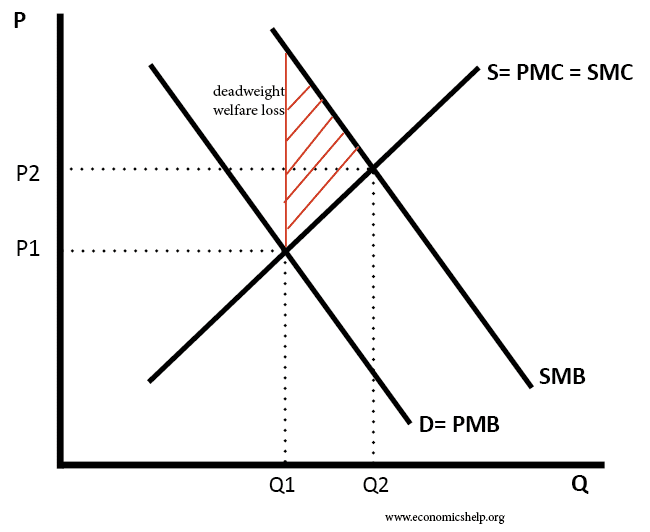

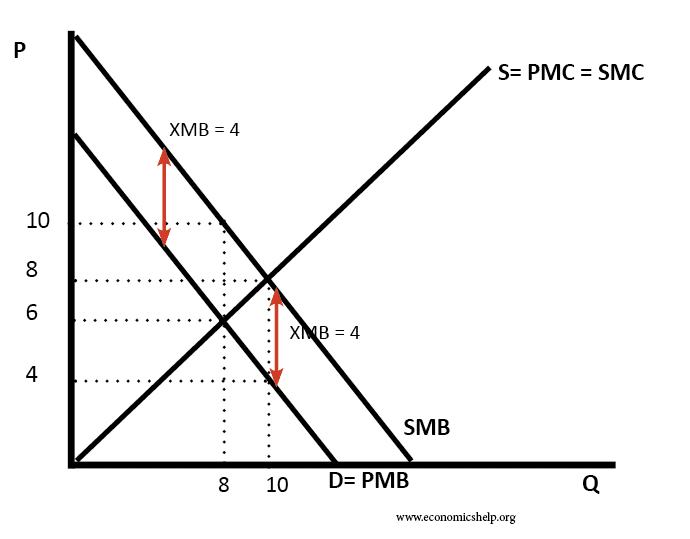

A list of different types of economic policies. Monetary policy Fiscal policy Supply-side policies Microeconomic policies – tax, subsidies, price controls, housing market, regulation of monopolies Labour market policies Tariff/trade policies Demand-side policies Policies for influencing aggregate demand and expenditure in the economy. This mainly involves fiscal and monetary policy. Fiscal policy Government changes to …